In today’s dynamic investment landscape, Contract for Difference (CFD) instruments have emerged as powerful tools for traders and investors alike. Offering flexibility and accessibility, CFDs play a pivotal role in modern investment portfolios. Let’s delve deeper into what makes CFDs a valuable asset class.

1. Diversification Opportunities:

CFDs provide investors with access to a diverse range of markets, including stocks, commodities, currencies, and indices, all within a single platform. This enables investors to diversify their portfolios easily, spreading risk across different asset classes and potentially enhancing returns.

2. Flexibility in Leverage:

One of the key features of CFD trading is its flexible leverage options. While leverage can amplify both gains and losses, the ability to adjust leverage according to individual risk preferences is invaluable for investors. It allows for better risk management and tailored trading strategies.

3. Hedging Capabilities:

CFDs offer investors the ability to hedge their existing positions in traditional markets. By taking opposing positions on correlated assets, investors can mitigate potential losses during market downturns, providing a level of protection for their overall portfolio.

4. Access to Global Markets:

Through CFDs, investors can easily access global markets that may otherwise be difficult or costly to trade directly. This opens up opportunities to capitalize on international economic trends and events, without the need for extensive capital or logistical barriers.

5. Trading Flexibility:

CFD trading platforms offer advanced tools and features that empower investors to execute their trading strategies efficiently. Whether it’s implementing stop-loss orders, setting price alerts, or accessing real-time market data, CFD platforms provide the necessary tools for informed decision-making.

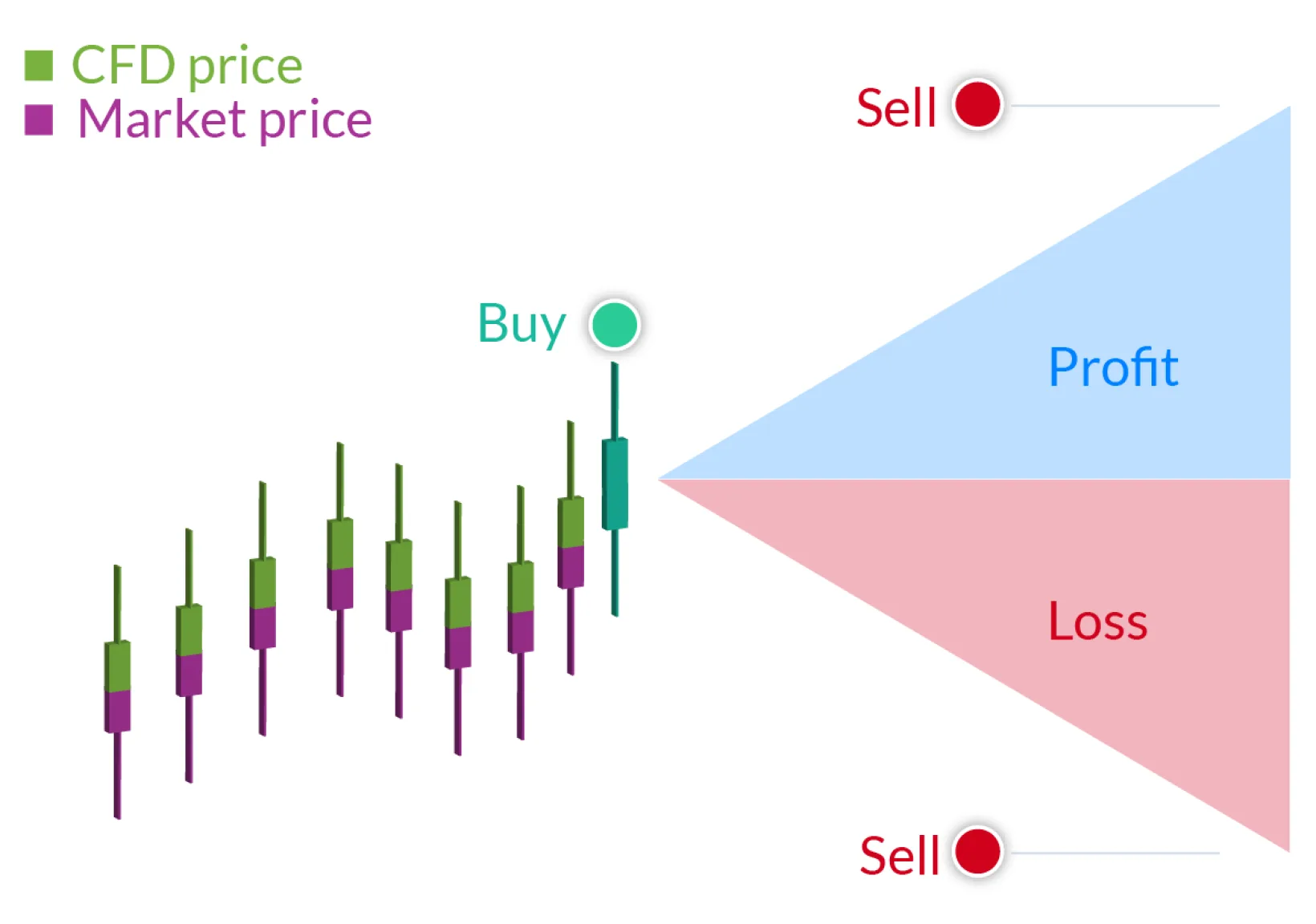

6. Potential for Short-Term Profits:

Due to their ability to profit from both rising and falling markets, CFDs are well-suited for short-term trading strategies. Traders can capitalize on price movements in various asset classes, regardless of market direction, thereby potentially generating profits in both bullish and bearish market conditions.

In conclusion, the role of CFDs in modern investment portfolios cannot be overstated. With their diverse range of markets, flexibility in leverage, and hedging capabilities, CFDs offer investors a versatile and powerful instrument to navigate today’s complex financial markets.